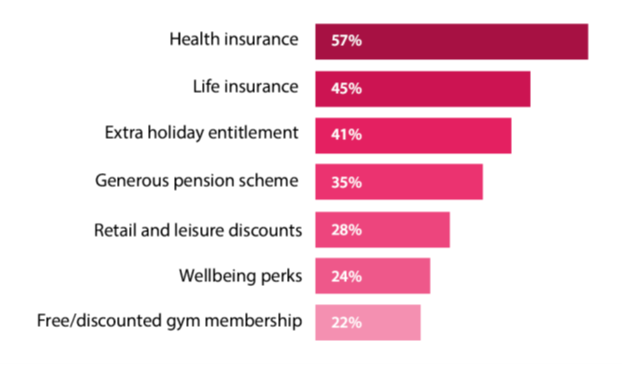

What are the most coveted employee benefits today? We sought the answer to this question as part of our recent survey of 641 start-up employees. Our method was simple. We asked workers at newly formed companies to select their top 3 most desired benefits.

We reveal the results in this blog post.

You can read the full employee benefits survey here. It makes important reading for any business owner or HR manager who wants to understand how best to reward their staff today.

The most popular employee benefits according to start-up employees

Here are the most popular workplace perks according to start-up employees:

Health insurance

More than half of employees (57%) selected private health insurance amongst their top 3 most desired benefits.

Private health insurance has always tended to finish high on employees’ wish-lists. Today, however, it seems to be taking greater precedence. People are likely worried about the consequences of needing hospital treatment during these uncertain times, so it’s no surprise that access to private healthcare is foremost in their minds.

The NHS has also been under greater strain than ever before, with the number of patients in England waiting over a year for routine hospital care now 100 times higher than before the pandemic, according to data from NHS England.

Life insurance

45% of start-up employees selected life insurance as a desired benefit – which caught us a little by surprise. In our survey of small businesses last year, only 16% earmarked life insurance as their most coveted benefit.

It likely reflects the depth of worry that exists at a time when the issue of mortality is ever-present across our various screens, newspapers and audio devices.

It’s worth noting that life insurance costs less than other forms of insurance, as data from Canada Life revealed in our employee benefits report. Its relatively low cost is primarily because claims are less common than in other forms of insurance.

Life insurance reassures employees that their loved ones are financially taken care of should the worst happen. Nobody likes to consider their own mortality, but it’s comforting to have a safety net.

Extra holiday entitlement

Well, who wouldn’t want extra holiday? 42% listed extra holiday entitlement amongst their priorities. It’s certainly a perk which stands out on a job advert.

While almost all workers are legally entitled to 5.6 weeks of paid holiday each year, a generous hearted employer can offer more on top of that. For example, car insurance provider ‘Marshmallow’ provide an extra two days a year which is intended for personal development. Discover more employee benefit ideas and inspiration here.

Extra holiday time is often at the top of employee wants as opposed to needs. And this can make them a useful addition to an employee benefits package alongside the more serious and sober support provided by health and life insurance.

How do you offer all things to all people?

Taken together we can see there is a wide range of desired employee perks. Clearly, start-ups are rarely able to offer everything to everyone. This highlights the need to get to the bottom of what your employees really want.

There are two key actions recommended for business owners looking to keep their teams happy:

- Consult your team – Arrange a workplace survey which puts all the possible choices in front of your employees and leaves space for them to add their own unique suggestions.

- Provide a flexible range of benefits – Allow employees to select from a choice of benefits rather than provide a “static” benefits package in which employees are auto-enrolled. This is perhaps the shrewdest way of ensuring that workers get what they truly want. Find out how employee benefits platforms can help.

How do you kickstart the process?

Businesses big and small often find it hard to set-up and manage employee benefits schemes. Why is this?

First, it’s hard to know who to trust. You may have an idea of what benefits you want to provide, but less sure about what you should be paying. What does a good value deal look like? How do you know if you’re paying over the odds?

One solution could be to research the market and check prices across different providers. The problem is every insurer has its own set of inclusions and exclusions (or Ts & Cs) so it’s almost impossible to make a direct comparison.

Secondly, managing and accessing employee insurance and benefit schemes can be made difficult (even though it doesn’t have to be the case). There are insurers out there who want to make claiming as awkward as possible. They will make you jump through hoops like a sheep dog at Crufts!

But don’t let that put you off. A good insurance broker can help. As an independent broker, Hooray Health & Protection helps SMEs get the best value deals AND assists with the claims process. Our mantra is to make insurance easy. We break down the jargon and work with you to get the best value – and most user-friendly – insurance package for your business and people.

We work across the market to source deals which are otherwise unavailable. Once we’ve delivered, we’re on hand to provide ongoing advice and help educate your team, so that managing your insurance schemes doesn’t become a headache.

Author

Author: Charlie Cousins

Founder and Director of Hooray Health & Protection, Charlie Cousins has enjoyed a career in the insurance and financial services industry spanning over the last ten years.

![_HPA24 Advice Firm of the Year [YELLOW] _HPA24 Advice Firm of the Year [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Advice-Firm-of-the-Year-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)

![_HPA24 Best Small Health Insurance Advice Firm [YELLOW] _HPA24 Best Small Health Insurance Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Health-Insurance-Advice-Firm-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Sales & Retention Advice Team [YELLOW] _HPA24 Best Sales & Retention Advice Team [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Sales-Retention-Advice-Team-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Small Protection Advice Firm [YELLOW] _HPA24 Best Small Protection Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Protection-Advice-Firm-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)