Every start-up founder longs for that extra bit of money to scale up their business. Whether it’s a tech company wanting to hire more developers or a product developer wishing to open a new factory; investment is often key to an entrepreneur realising their dreams.

That’s why more than 5000 UK businesses currently source venture capital and private equity, according to the BVCA. But what is Venture Capital? And how does it work? This article explains all.

Need help finding the right employee benefits and support for your SME or start-up business? Give our friendly award-winning brokers a call on 01273 222805 or email hello@hoorayinsurance.co.ukFREE advice and support.

What is venture capital?

Venture capital (VC) is an investment fund dedicated to start-ups and small businesses who are considered to have high growth potential. These are usually young pre-profit and, sometimes, even pre-revenue businesses. The venture capitalist is a wealthy individual or a dedicated investment company that puts their money into such companies in return for equity* in that organisation.

As well as providing financial support, the investor may also offer their business expertise and contacts to further support their investment.

And the overall aim of this? To help these companies grow faster, fulfil their potential and give the investor a handsome return.

Kind of a win-win, right?

VC investors mainly target new companies – young, pre-profit, even often pre-revenue. As the company grows, so does the revenue, and eventually so does the value of the VC investors’ ownership stake.

*the value of the shares issued by a company / the percent ownership of a company.

The different stages of venture capital

Right, let’s get into some more details!

There are different types of VC funding, all dependent on the maturity and growth levels of the business. BVCA defines the stages of VC investment as follows:

Seed funding

This allows an initial business concept to develop. This could involve helping the production of a business plan, prototypes and additional research – all prior to bringing a product to market with large-scale manufacturing.

Start-up funding

This is for use in product development and initial marketing initiatives. These companies haven’t sold their product commercially yet and might be in the process of being set up or have only been around for a short amount of time.

Other early stage funding

Funds may also be committed to companies which have developed the product but are in need of further funds to kickstart commercial manufacturing and accelerate sales. These companies might not have generated profits yet.

Late stage venture funding

Venture Capital may also be ploughed into companies that have reached fairly stable growth. In other words, they are still growing, just not as fast as they were at the start. These companies are not necessarily profitable, but are more likely to be than in earlier stage businesses.

Expansion funding

Investment can also be directed to companies which are already turning a profit, but need extra financial support to grow, expand, and further develop. This capital is used to increase production capacity, market/product development, and provide additional working capital.

If you’re an ambitious company seeking to attract the best people to your business, then it might be time to reconsider the workplace perks you provide to employees. Hooray Health & Protection is an independent benefits broker which provides FREE advice and guidance to start-ups and SMEs. We’ll review any schemes currently in place and provide price-points for all the perks you might consider providing to employees.

Contact our friendly team on 01273 222805 or hello@hoorayinsurance.co.uk.

Why do companies seek out venture capital?

There are many reasons why young companies turn to venture capital funding. We’ve mentioned some of them above, but to summarise:

- To grow their manufacturing and sales operations

- To enhance product development

- To expand the business e.g., hiring new talent

- To develop an initial business/product model

- To bring a product to market, building genuine value in that product

- To gain access to business expertise and contacts

- To avoid having to take out loans which need to be paid back with interest

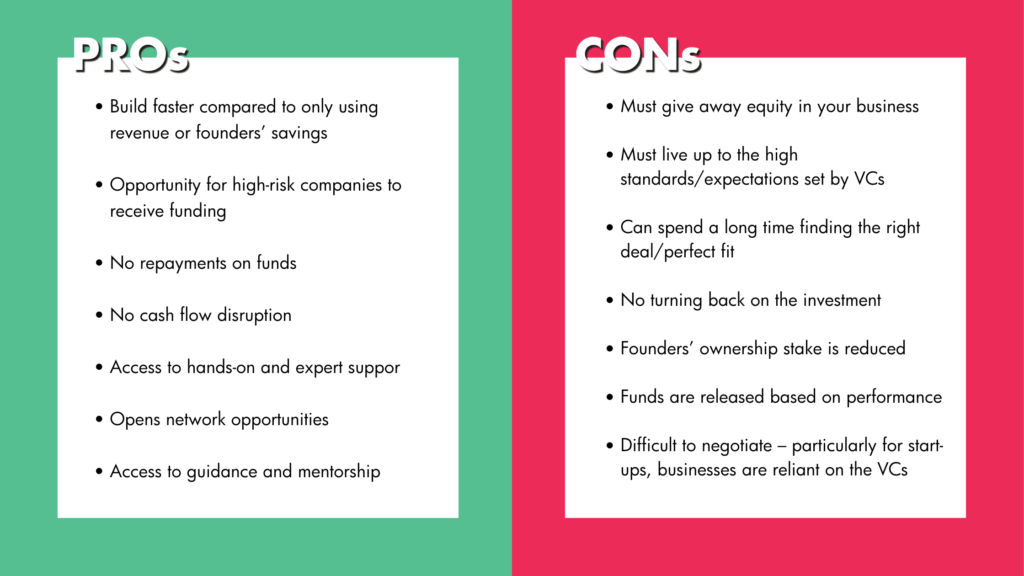

What are the pros and cons?

What are the alternatives to venture capital?

Start-ups and small businesses have other ways to raise investment:

Angel Investors: Usually a single investor seeking investment opportunities. Angel investors use their own net worth as funds and act privately to finance SMEs and start-ups.

Peer-to-peer lenders: Allows businesses to receive loans from other individuals or groups, cutting out the traditional middle man. Peer-to-peer lending platforms match lenders to borrowers online.

Crowdfunding: Get funding from a large group of people all contributing small amounts.

Accelerators and incubators: Similar to Venture Capital, but accelerators and incubators are involved purely in early stage start-ups with emphasis on providing advice, mentoring and resources.

Government grants: Some businesses may be lucky enough to qualify for a Government grant –usually social enterprises and environmental initiatives. Grants are offered locally and nationally.

Friends and family: If all else fails, you can consider encouraging family and friends to invest money. However, relations can be strained if you set expectations too highly!

Finding the right people and the right investment is key

When it comes to building a successful business, there are many ways to get your product development and marketing up and running. Venture Capital investment is just one option for the eager entrepreneur.

However, businesses can only meet their ambitions if they have the right people propelling it forward.

At Hooray Health and Protection, we specialise in helping start-ups and SMEs find the perfect employee benefits and health protection plans to support their staff and growing businesses. As a result, we deal with many VC-backed firms in our own line of business. So, we’re well-versed in handling any queries when it comes to finding the right benefits and perks for these organisations.

Our friendly (did we mention award-winning?!) team of experts will take the time to listen to your specific needs and answer any question on employee benefits and health insurance. We bring you the best quotes and deals in the UK market, ensuring you achieve the best value with the best results.

Contact us at hello@hoorayinsurance.co.uk or call 01273 222805 for FREE no-obligation advice and support.

Author

Author: Eleanor Chilvers

![_HPA24 Advice Firm of the Year [YELLOW] _HPA24 Advice Firm of the Year [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Advice-Firm-of-the-Year-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)

![_HPA24 Best Small Health Insurance Advice Firm [YELLOW] _HPA24 Best Small Health Insurance Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Health-Insurance-Advice-Firm-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Sales & Retention Advice Team [YELLOW] _HPA24 Best Sales & Retention Advice Team [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Sales-Retention-Advice-Team-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Small Protection Advice Firm [YELLOW] _HPA24 Best Small Protection Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Protection-Advice-Firm-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)