Perhaps unsurprisingly, Group Income Protection is one of, if not the, most sought-after insurance benefit by employees.

Despite the demand, with only about 17,500 policies in the whole of the UK, most employees have never heard of it or at least don’t really understand what it covers.

In this guide, we are going to explain Group Income Protection and help businesses find their perfect policy for the best price.

- 1 What is a Group Income Protection Insurance Policy?

- 2 How to choose the right scheme set up for a business?

- 3 Is Group Income Protection expensive?

- 4 Do companies have to offer it to all employees?

- 5 How do claims work on Group Income Protection Insurance?

- 6 What should we know about Group Income Protection taxation?

- 7 Should I pay for a Group Income Protection comparison?

What is a Group Income Protection Insurance Policy?

Group Income Protection is an insurance policy paid by businesses to provide their employees with a fixed monthly compensation for any covered time that they are unable to work.

Statutory sick pay is available from the UK government but is only £95.85 per week for up to 28 weeks. Employees who usually earn more than this sum often find that they struggle financially with the decrease.

These struggles can also cause employees to rush back to work before they have fully recovered. Doing so is not only bad for their health but is also sometimes counter-intuitive, with more sick leave being required further down the line.

Group Income Protection allows any sick or injured staff to fully recover at their own pace while using the support services the policy offers to assist with their recovery.

How to choose the right scheme set up for a business?

The best way to find your perfect scheme is to speak to a broker, who can help you establish your business risk appetite and budget. Here at Hooray Health and Protection, we will not charge you for an initial assessment, as we are paid a commission by the insurance companies.

Group Income Protection does not cover 100% of an employee’s monthly salary, as there needs to be an incentive for staff to return to work once they have recovered. Instead, you can provide a maximum of 80% of their income per month and include pension or national insurance contributions.

You can also choose criteria to incentivise senior staff, attract talent or reward staff loyalty. For example, you could provide 50% of their salary for the first two years of employment, then increase to 70% after they have met the two-year service criteria.

The same goes for the payment period. You can choose the policy to pay for two years, five years or even until retirement and set different levels for factors such as seniority. The longer the payment period, the more expensive your policy’s premiums will be.

Before the policy starts to pay, a deferred period must be chosen, which is the designated period an employee must be absent from work before payment kicks in.

Deferred periods will commonly be either 13, 26 or 52 weeks, depending on the business’ internal sick pay policy and risk appetite.

There are numerous other factors such as covering pension/national insurance contributions, offsetting state benefits and setting an escalation rate which will also be unique to a business’ goals.

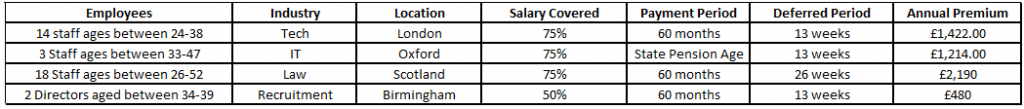

Is Group Income Protection expensive?

It’s the question everyone wants to know when choosing a policy, but the answer will be different for every business! The cost of your premiums will depend on the number of employees, the average age of the workforce, the industry you work in, where you’re located, the scheme design and many other factors.

Hooray Health and Protection can help you save money by charging no fee for our services. The price you pay through us will always be the same as you would pay the insurer directly, but we will do all the legwork in finding the best deal!

Below we have provided some price examples for small businesses which all have no pension/national insurance contributions, no escalation, no offset etc. included.

Do companies have to offer it to all employees?

It is the business’ choice which staff are covered under the policy. They cannot pick and choose specific employees to cover, but they can instead set categories.

Common categories include Directors, Managers, Sales, Administration and a certain length of service. Your business does not have to provide the same level of benefit to each category, so you may want to provide higher benefits to more senior or long-serving staff, for example.

Here at Hooray, we can run you through numerous quotes for different cover options, but we know from experience that it often works out cheaper to include more staff than less.

Including categories which have a younger workforce such as administration or sales, can potentially bring the premium down because decreasing the average age of the scheme makes it a more attractive risk to the insurer.

How do claims work on Group Income Protection Insurance?

Once you have arranged your policy, you need to remember for future absences that all the insurers provide an early intervention service to help support your staff back to work.

If you or any of your employees have a serious illness or accident making you unlikely to return to work for longer than the deferred period, always contact your broker straight away.

Insurers want to help employees get back to work as soon as possible, as it reduces the cost to them. This makes Group Income Protection a win-win, as your business will also see less disruption!

Group Income Protection providers will look at funding private treatment, completing workplace assessments, assisting with role re-training and other services to assist with any long-term workplace absences.

To keep your employees healthy, Hooray Health and Protection only work with insurers that have a proven track record at managing early intervention support and providing rehabilitation services.

What should we know about Group Income Protection taxation?

Every company is different, and we are insurance brokers – not tax experts. So, we always advise our clients to seek advice from their accountant, tax expert or HMRC before proceeding.

When providing Group Income Protection to their workforce, businesses will usually be able to claim the premiums as a business expense against corporation tax relief.

It is also worth pointing out that Group Income Protection policies are not treated as a P11D benefit. When a successful claim is made, the benefit is paid to the business to be taxed as per usual employee earnings.

Should I pay for a Group Income Protection comparison?

Hooray Health & Protection do not charge any fee, no matter the size of the client, as we are paid a commission by the Group Income Protection insurers for placing business with them.

If you are currently paying a fee or considering a new policy, give one of our friendly advisors a call on 01273 222805 for a free assessment of how much you could be saving!

Author

Author: Charlie Cousins

Founder and Director of Hooray Health & Protection, Charlie Cousins has enjoyed a career in the insurance and financial services industry spanning over the last ten years.

![_HPA24 Advice Firm of the Year [YELLOW] _HPA24 Advice Firm of the Year [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Advice-Firm-of-the-Year-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)

![_HPA24 Best Small Health Insurance Advice Firm [YELLOW] _HPA24 Best Small Health Insurance Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Health-Insurance-Advice-Firm-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Sales & Retention Advice Team [YELLOW] _HPA24 Best Sales & Retention Advice Team [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Sales-Retention-Advice-Team-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Small Protection Advice Firm [YELLOW] _HPA24 Best Small Protection Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Protection-Advice-Firm-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)