There is no shortage of workplace protection providers in the UK. The likes of Aviva, KPMG and Legal & General are among the insurers vying for your attention. But what of Canada Life UK?

Canada Life offers three core workplace protection policies:

- Group Life Insurance

- Group Income Protection Insurance

- Group Critical Illness Cover

We put these three policies under the microscope with the help of our very own Employee Benefits Consultant, Stuart Isaac. Plus, we get the insurer’s perspective from Canada Life’s Strategic Account Manager, Jason Adams.

Need impartial advice about workplace protection schemes offered by Canada Life or any other provider? Call our friendly award-winning brokers for FREE guidance on 01273 222805.

About Canada Life

Canada Life established itself in the UK back in 1903, so it’s certainly no newcomer to the market. Aside from workplace protection, Canada Life also provides services related to investment plans, retirement plans, home finance, estate planning and individual protection policies. Today, Canada Life serves 3.4 million UK customers.

Policies offered by Canada Life

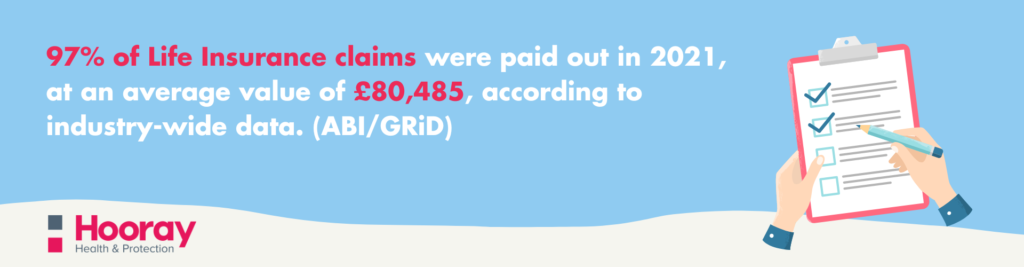

Group Life Insurance

Explainer:

Group Life Insurance is a cost-effective way for businesses to provide life insurance to their employees: the larger the workforce the greater the per person discount. It’s a tax-deductible business expense and background medical checks are very rarely needed, making it available to all employees equally.

As with any life insurance scheme, an employee’s family (or selected beneficiaries) will receive a tax-free payment should they pass away while employed by the business.

Key features and benefits:

- Available for businesses with two or more employees, making it suitable for the smallest businesses as well as much larger ones

- Employer sets how much is paid out in the event of a claim – either calculated as a lump sum or a multiple of the employee’s salary

- Different employees can be given different coverage levels (for example, this could be related to seniority within the business, length of employment or any other criteria you see fit to set)

- Easy to set up with simple annual accounts (no background medical checks required in most cases, making it the easiest insurance type to administer)

- Bereavement counselling is provided for an employee’s family should the worst happen

- Legal support is available should employees have any probate issues to deal with

- Policies are set up either under a discretionary trust or a Master Trust (a discretionary trust is set up by you, the employer, while a Master Trust is a pre-arranged trust available via Canada Life)

- Access to mental wellbeing app myStrength

- Access to “WeCare”, an Employee Assistance Programme which helps with mental, physical and financial health issues

What’s special about Canada Life’s Group Life Insurance policy?

Hooray’s Employee Benefits Consultant, Stuart Isaac, is keen to highlight Canada Life’s overall customer service and its generous bundling of an Employee Assistance Programme (EAP) with the Group Life policy.

The “WeCare” EAP provides a range of physical, emotional and financial support services including: 24/7 virtual GP access, medical second opinion services, one-to-one counselling services, expert financial guidance – and much more.

“Canada Life provides an EAP with its Group Life policy which isn’t the case with all insurers,” said Stuart. “They are often reserved for more expensive products, like Group Income Protection or Group Critical Illness policies. It’s also extremely easy to access and can be used by the whole family. I recently supported a family member’s business with a Group Life policy and their ‘WeCare’ EAP was all automated and easy to register for.”

Stuart is also complimentary about the customer service offered by Canada Life.

“Canada Life’s team are great and always available at the end of the phone to support with any onboarding queries and general questions.”

And if the broker receives good customer service, so does the end customer.

“Canada Life have provided a full broker ‘pack’, which gives us slides, presentations and welcome packs to make it really clear what the client will get for their premium.”

Does Canada Life have the perfect policy for you? Call our team of independent brokers for one-to-one advice. We’ll compare and contrast policies from across the market to ensure you get the best value policy for your workforce. Call us on 01273 222805 or email hello@hoorayinsurance.co.uk

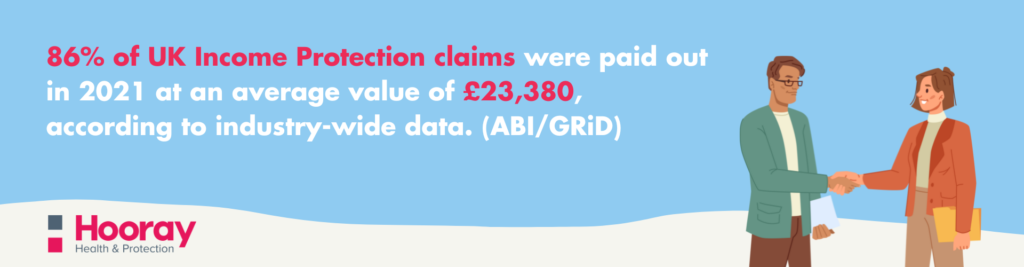

Group Income Protection

Explainer:

Explainer:

Group Income Protection provides financial and rehabilitation support to employees who are long-term sick or injured. The basic idea is that it kicks in when the statutory sick pay has ended, so that an employee whose illness or injury lasts beyond this point can access financial support. It’s of great help to business and employee alike as it can speed up recovery while ensuring that the individual does not face any financial hardship.

Under Canada Life’s Income Protection plans, employees will receive emotional and financial support, and access to rehabilitation experts. This allows businesses to cut time spent managing staff absence and avoid the financial burden of topping up sick pay out of their own budget AND potentially hiring staff to cover for the absent employee.

Furthermore, the employer can gain access to absence management specialists, if necessary, on day one of staff absence to assist with rehab and recovery.

Key features and benefits:

- Accessible to businesses with two or more employees

- Cover can be offered for up to 75% of employees’ salaries

- Cover for pension and National Insurance contributions

- Easy to set up with simple yearly accounts

- Early intervention team help employers manage workplace absence

- Access to Canada Life’s in-house rehabilitation and claims professionals

- 24/7 online GP, mental health support and virtual wellbeing with WeCare EAP

- Second medical opinions from over 50,000 consultants around the world

- Employee perks app providing discounts with leading brands, including retail, cinema and dining.

- Customisable wellbeing calendar alerting employees of webinars, toolkits and other resources

What’s special about Canada Life’s Group Income Protection plan?

Absence management is one key area where Canada Life stands out, according to Jason Adams, Strategic Account Manager at Canada Life.

“We offer day one absence management via our dedicated in-house nursing team, mental health training and our WeCare and MyStrength support services are available to all employees whether they are insured or not and their immediate families at no extra cost.

“HR or line managers can call a dedicated helpline for immediate support and guidance. The helpline is staffed with our in-house registered nurses, occupational therapists and vocational rehabilitation consultants as well as all being Mental Health First Aiders. If we believe early intervention could help, we will contact the absent employee to discuss the absence and offer support.

“Once the employee has been contacted, we will compile a report offering practical help and guidance for you, as well as support for a return-to-work plan if appropriate.”

“The service returns employees back to work in an average of four weeks, leading to significant savings in HR time and occupational sick pay.”

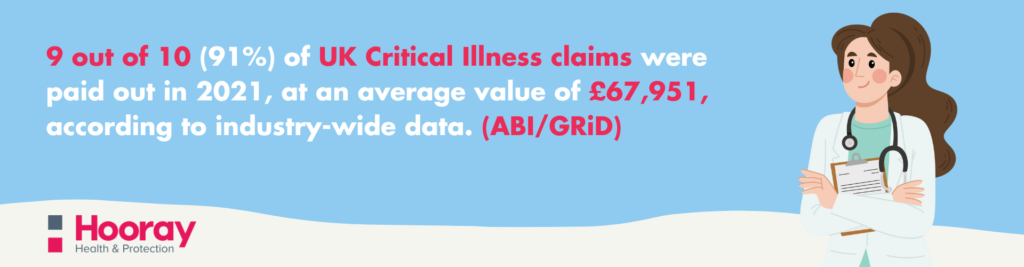

Group Critical Illness

Explainer:

Group Critical Illness policies provide financial and practical support to employees with a serious illness, so they can focus more of their time and energy on their wellbeing.

Key features and benefits:

- Available for two or more employees

- Pays employee with a tax-free amount

- Pay out is made as a fixed amount or as a multiple of the employee’s salary (up to a maximum of £500,000)

- No medical background checks required in most cases

- Children’s cover included as standard

- 13 core illnesses covered, including heart attack, cancer and stroke

- A further 28 conditions can be added for more comprehensive cover

- Cover for Total Permanent Disability (TPD) can be included

- Long-term support from a qualified nurse

- A second medical opinion on almost any treatment or diagnosis

Illnesses covered:

Every Canada Life Group Critical Illness policy covers at least 13 core illnesses, including:

- Alzheimer’s

- Stroke

- Cardiac Arrest

- Cancer

- Heart attack

- Coronary artery bypass grafts

- Creutzfeldt-Jakob disease (CJD)

- Parkinson’s disease

- Dementia/pre-senile dementia

- Kidney failure

- Motor neurone disease

- Major organ transplant

- Multiple sclerosis

What’s special about Canada Life’s Group Critical Illness plan?

Jason Adams, Strategic Account Manager, Canada Life emphasises the practical support provided to affected employees:

“Anyone who makes a claim will receive long-term practical and emotional support, not just for themselves, but also for their families from a qualified nurse. They can also get access to a second opinion on almost any treatment or diagnosis from a world-leading consultant, available to employees and their immediate family.

“Employees’ children are automatically covered for free with every policy. If they’re under 18, or 22 if in full-time education, they’ll be covered for 25 per cent of the employee’s benefit, up to a maximum of £20,000.”

What extra services does Canada Life offer?

- Flexible benefits option: Allowing your company to choose which benefits to offer, while enabling the employee to set the level of coverage. This can be paid for by the employee through the business, rather than by the business itself.

- WeCare platform: An extensive range of virtual services, including 24/7 GP consultations, mental health support, fitness programmes and much more.

- Toothfairy app: Designed by dentists, this app provides advice, support and prescriptions related to ‘mouth health’ for employees, wherever they are working form.

- myStrength: A mental wellbeing app which includes guided meditations, sleep support and other means of improving and safeguarding mental health.

- Employee perks app: A staff discount scheme only available to Group Income Protection scheme holders.

The broker’s verdict on Canada Life

The team at Hooray has enlisted the services of Canada Life for a wide range of start-ups and SMEs. We’ve found that the company has always gone out of their way to support smaller businesses, some of whom might have struggled to access group protection plans due to being considered ‘too small’.

Could Canada Life be the best option for your business?

It’s impossible to give blanket approval as every business has a unique set of needs. The best bet is to get in touch with one of our expert brokers who will compare and contrast different policies provided by different insurers – and deliver the pick of the quotes direct to you.

Hooray’s service is completely free of charge, so feel free to get in touch and pick the brains of our award-winning team.

Call us on 01273 222805 or email hello@hoorayinsurance.co.uk

Author

Author: Mel Dixon

Mel is a journalist, editor and digital content writer who has written extensively on issues affecting the small business community.

He trained as a journalist at Southampton Solent University which propelled him into a 12 year career as a freelance writer and communications professional.At the start of his freelance career, Mel launched the blog for accountancy firm Crunch and wrote a regular tax advice column for Photo Professional Magazine. He was a finalist in the Freelancer of the Year Awards 2010.Today, he writes about health insurance, employee benefits and employee wellbeing more generally.Mel keeps an eye on all the industry news and is a regular reader of Health & Protection, Cover Magazine, Employee Benefits and The Human Times, among other publications.

![_HPA24 Advice Firm of the Year [YELLOW] _HPA24 Advice Firm of the Year [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Advice-Firm-of-the-Year-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)

![_HPA24 Best Small Health Insurance Advice Firm [YELLOW] _HPA24 Best Small Health Insurance Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Health-Insurance-Advice-Firm-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Sales & Retention Advice Team [YELLOW] _HPA24 Best Sales & Retention Advice Team [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Sales-Retention-Advice-Team-YELLOW-qwfw5yu97kzz3xrji5hslrgaxvljimbic1gmmgr7m8.png)

![_HPA24 Best Small Protection Advice Firm [YELLOW] _HPA24 Best Small Protection Advice Firm [YELLOW]](https://hoorayinsurance.co.uk/wp-content/uploads/elementor/thumbs/HPA24-Best-Small-Protection-Advice-Firm-YELLOW-qwfw5zs3ef19fjq6cnwf697rj9gwqbf8o6443qptg0.png)